SAVVY: AN APP THAT LOOKS LIKE YOU!

SAVVY: AN APP THAT LOOKS LIKE YOU!

THE CHALLENGE

How can we help people who work, to save money in a digital way?

THE DATA SPEAKS

37% of entrepreneurs lack financial planning

36% doesn’t know how to do it

17% doesn’t have the time to do it

LATAM is the region with the highest rate of entrepreneurial activity in the world with 24.6%

Understanding the user perspective,

we created the personas to help us move forward

with our decision-making.

Research goals:

Identify pain points and unmeet needs that current banks/financial apps services do not address to all type of costumers.

Explore and identify patterns of finance management amongst people in Latam.

Research findings/ from the expert:

The lack of clear savings goals and lifestyle are crucial factors that shape their financial plans and savings habits.

The lack of knowledge in financial tools (at any age) generates anxiety who later sums up the dislike towards financial entities.

Having long-term goals is crucial to stay motivated in having a savings plan.

Financial health promotes emotional well-being.

Each person has a unique saving goal and different priorities, thus there’s not an unique approach that works for everyone.

In Latin American countries, there does not exist a financial and saving culture that is considered strong, people often like to see investment returns in short-term periods of time.

The willingness to learn and explore digital tools and financial topics shows a proactive attitude towards financial literacy.

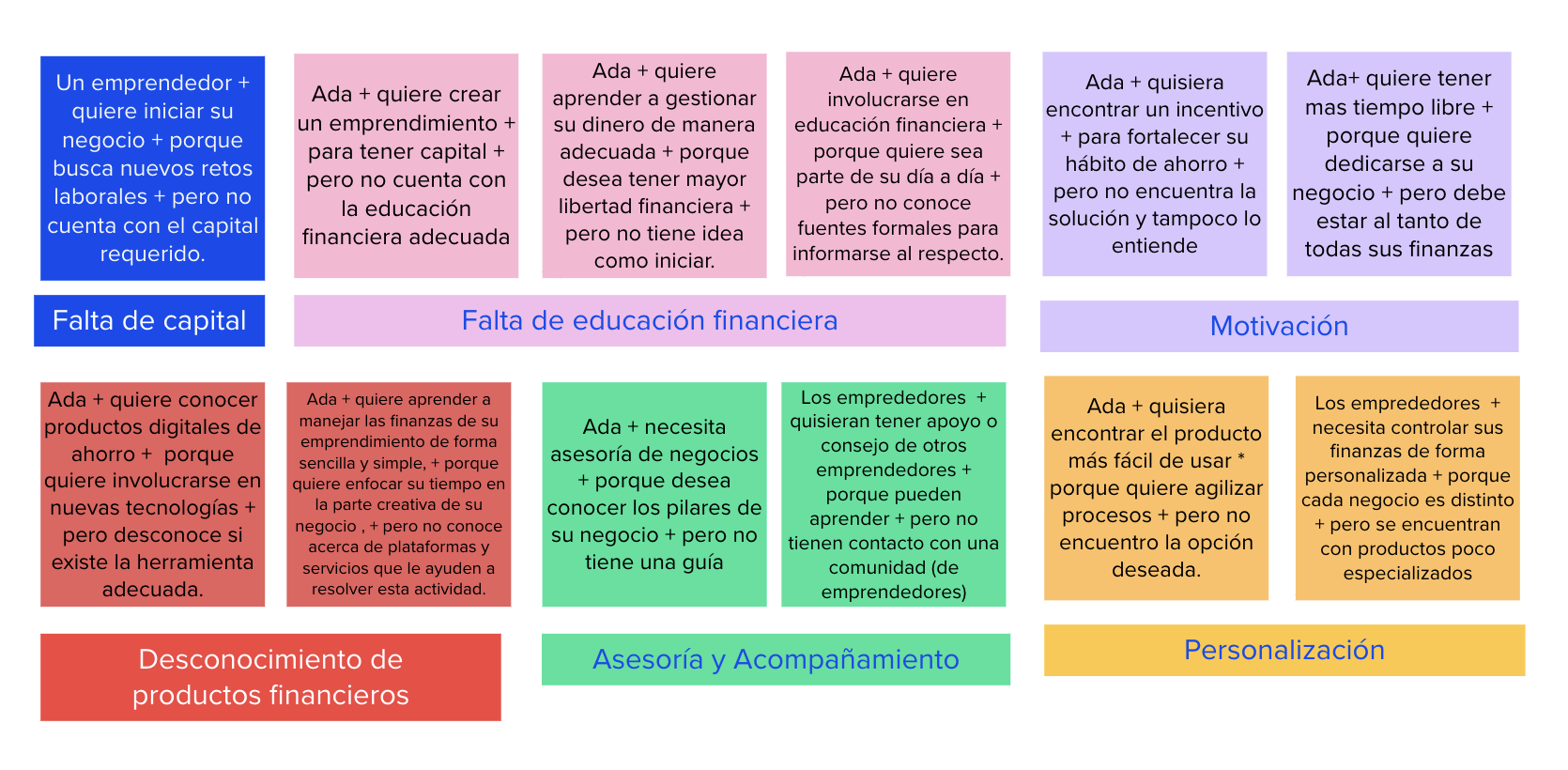

From the user:

The user hasn’t had good financial habits like budget, expenses tracking or savings goals.

There is a general dislike towards banks and financial entities due to previous bad experiences, technical language, processes, etc.

Entrepreneurs doesn’t have regular incomes.

To minimize the financial stress entrepreneurs face due to their poor financial habits is a primary goal.

The user would like to have an app that can be personalized for her own needs as an entrepreneur.

Entrepreneurs would like to have support or advice from other entrepreneurs but they do not have access to a community.

Entrepreneurs need to control their finances in a personalized way because each business is different but they find themselves with unspecialized products.

They would like to find an incentive to strengthen their savings habit but they can't find a solution that provides one.

User Persona

Our user persona doesn’t have a regular income. She struggled most of her life with savings, budgeting and more.

To better understand the financial challenges Latam people face, I first dive into user interviews. By asking open-ended questions, I explore and navigate through the different financial concerns they have, their goals, and what could be the greatest pain points when it comes to saving money. Additional, I ran an expert interview to know better about finance culture around Latin American countries.

Persona/Pain points

She would like to better manage her income.

"I hate numbers".

As an entrepreneur, income comes in unregular periods of time.

She thinks there isn’t an app that meets her needs and finance educational level.

Considering the persona and research data, I aim to address the specific problem through a targeted question

“How might we design a hyper-personalized solution that provides options according to different savings needs, taking into consideration all kind of incomes, corporate and entrepreneurial.

Brainstorming and the solution:

Empathizing with the pain points of our personas, I generated several potential ideas and settled on the solution of creating a hyper-personalized app that meets each and unique user needs.

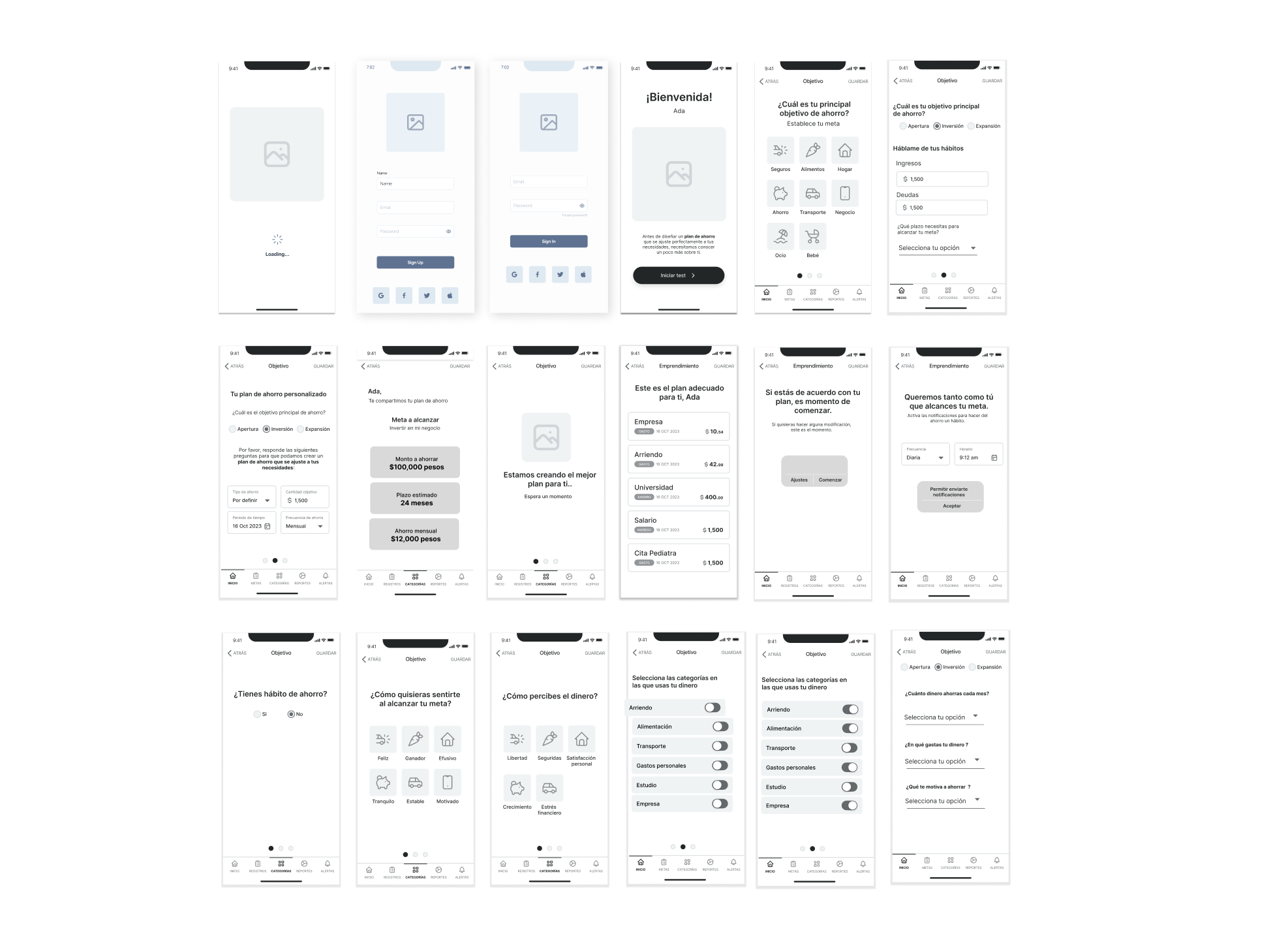

Wireframes

Early sketches on the various possible appearances of the interface.

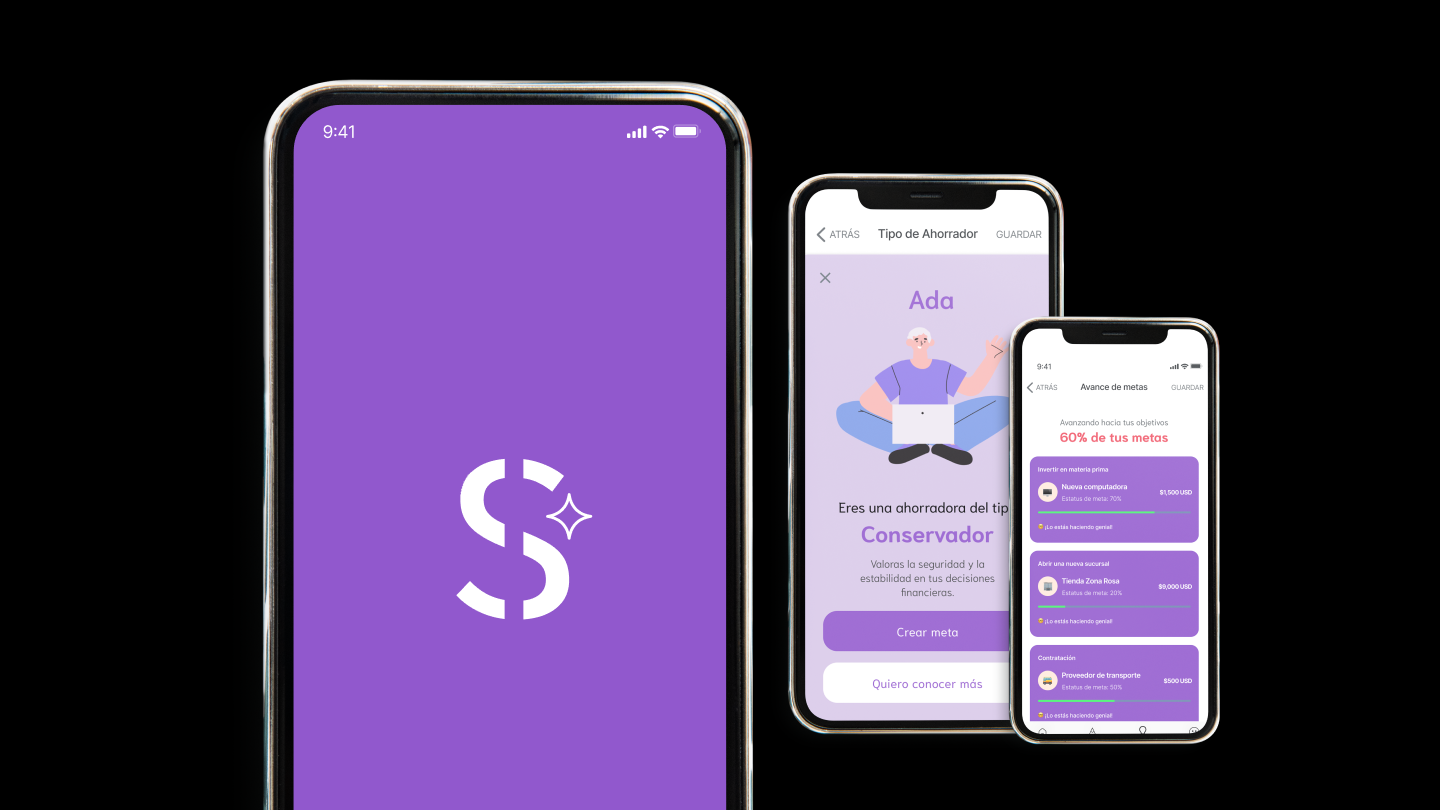

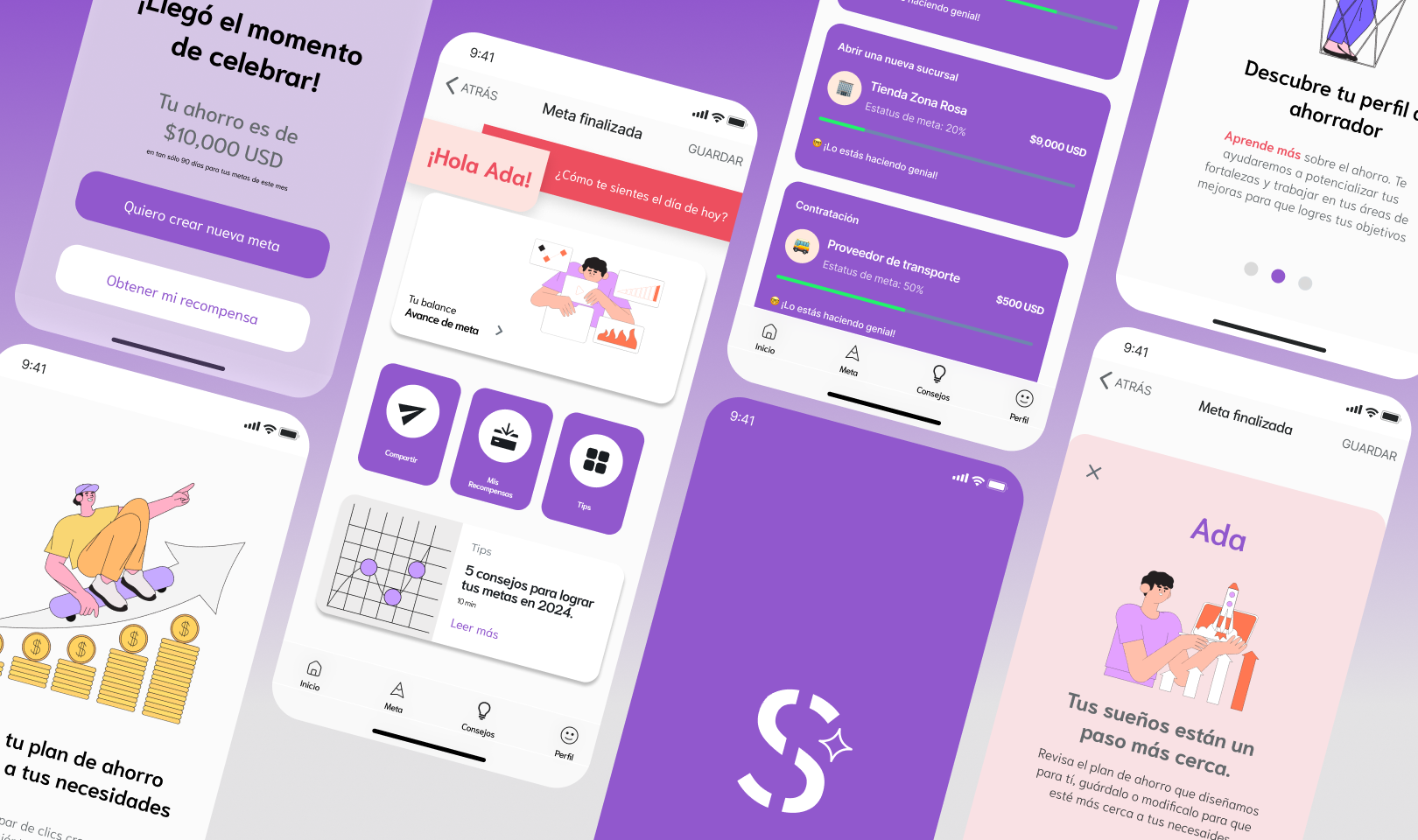

Introducing Savvy

A savings app that looks like you!

An app that identifies your savings archetype based on a personality test and personalizes your budget plan based on your unique results.

In order to differentiate ourselves from banks and old-fashioned finance institutions, we needed a color palette that stands out and evocates freshness and relaxation for our young audience, that’s why we decide purple was our best shot.

When making user interface decisions, we wanted to make Savvy a friendly and trusty app, in order to do it, we implement cheerful illustrations and a direct and simple language as well.